44 Years of Cato Policy Report

This is the last issue of Cato Policy Report (CPR) after 44 years. In that time, we have presented original articles on policy, history, law, economics, international affairs, and the principles of liberty. We have covered major Cato Institute events, including policy conferences such as “The Search for Stable Money” in 1983—featuring James Buchanan, Karl Brunner, Allan Meltzer, Fritz Machlup, and Anna Schwartz—our conferences in Moscow and Shanghai, and Milton Friedman Prize dinners.

leadWe have published some 301 issues, of which I edited 276 after joining Cato in 1981. Looking back, I remember a wide range of topics and some fascinating essays. The very first issue featured “Social Security: Has the Crisis Passed?” by Carolyn L. Weaver. That was appropriate since reforming the Social Security program became a signature Cato issue that generated books, conferences, and continuing engagement with policymakers who mostly didn’t want to face the problem.

William A. Niskanen, then a member of President Reagan’s Council of Economic Advisers, made his first appearance in CPR in May 1983 when he commented on Lawrence H. White’s book Free Banking in Britain. I still remember one point he made in his talk: the burden of proof in policy ought to rest with those “who propose restrictions on consensual relations of any kind.” But in practice, the burden of proof is on those who are proposing change—and within the government, on those who propose to reduce government’s discretion.

Two years later, when Niskanen became Cato’s chair, he gave an inaugural lecture, “The Growth of Government.” I remember the way he set out Cato’s distinctive perspective:

,We will differ from the dominant political traditions primarily when they try to use the powers of the state to impose their particular values on the larger community. We will oppose contemporary liberals when they fail to distinguish between a virtue and a requirement. We will oppose contemporary conservatives when they fail to distinguish between a sin and a crime.

Nineteen ninety‐two was a big year for CPR. In successive issues, we published lead articles by P. T. Bauer, later the first recipient of the Milton Friedman Prize; Norman Macrae, the longtime deputy editor of The Economist; and the great philosopher Karl Popper. That last was one of my great accomplishments as editor. I had read that a paper by the ailing Popper had been given at the annual meeting of the American Economic Association. I wrote to the scholar who had presented it for him and then wrote to Popper at his home in New Zealand, and I got permission to publish his paper. In it, he wrote about F. A. Hayek, Ludwig von Mises, and the Mont Pelerin Society, but most especially how Hayek was right to warn that socialist planning could only be implemented “by force, by terror, by political enslavement”—and thus, Popper added, the Soviet Union became an empire ruled by lies.

Over the years, we published other great thinkers: Robert Nozick on why intellectuals hate capitalism, Thomas Sowell on the economics and politics of race, Nat Hentoff on the First Amendment, James Buchanan on constitutional political economy, Deirdre McCloskey on bourgeois virtues, Ronald Coase on China, Steven Pinker on the Enlightenment, and Clarence Thomas’s powerful dissent in the Supreme Court’s 2005 medical marijuana case.

And, of course, most of our own great Cato scholars contributed to CPR. Tom G. Palmer wrote on a wide variety of topics—infrastructure, attacks on libertarianism, misconceptions about individualism, and modern threats to liberty. Doug Bandow reported on his trip to North Korea, Julian Sanchez on Edward Snowden’s revelations, Peter Ferrara and Michael Tanner on needed changes to Social Security, Roberto Salinas‐León on Andrés Manuel López Obrador’s “fourth transformation” of Mexico, and Clark Neily on “our broken justice system.”

From time to time, we have delved into historical topics, partly because people get much of their understanding of government and policy from history. Jim Powell took aim at Woodrow Wilson and Franklin D. Roosevelt, while Michael Chapman excoriated Theodore Roosevelt. Brian Domitrovic celebrated the tax revolt of the 1970s and 1980s. George H. Smith pondered what Stanford should teach regarding “Western civilization.” Steven Davies traced how the world became modern.

Editing Cato Policy Report all these years has been a great opportunity for me to engage with policy and ideas. I hope the editors of Cato’s new magazine will have an equally stimulating experience.

Posted on November 3, 2023 Posted to Cato@Liberty

King Biden Issues Another Decree

Newspaper headlines proclaim that President Biden has issued a “massive, sweeping, wide‐ranging” executive order on artificial intelligence. And no one seems to be saying that whatever the content of the order is, “massive, sweeping, wide‐ranging” regulations should not be issued by one man.

President Biden, members of Congress, and the judiciary should take a look at the White House’s own website, where they would read: “Under Article II of the Constitution, the President is responsible for the execution and enforcement of the laws created by Congress.” Not to make the laws, but to execute and enforce them. If AI needs government attention, it should come from Congress.

Biden is not the first president to believe that his office was invested with kingly powers. Both President George W. Bush and President Barack Obama used executive orders to grant themselves extraordinary powers to deal with terrorism. Lawmaking by the president, through executive orders, is a clear usurpation of both the legislative powers granted to Congress and the powers reserved to the states.

Clinton aide Paul Begala once boasted: “Stroke of the pen, law of the land. Kind of cool.” President Obama declared: “We’re not just going to be waiting for legislation.… I’ve got a pen, and I’ve got a phone, and I can use that pen to sign executive orders and take executive actions and administrative actions that move the ball forward.” President Donald Trump upped the ante: “I have an Article II, where I have the right to do whatever I want as president.”

One of the great concerns of the Founders was to rein in executive power. Thus they wrote a Constitution to divide and limit the powers of all elected officials. But they thought that each branch would be jealous of its own authority and would not tolerate a usurpation of its power by the other branches. Somehow Congress and the courts have lost their taste for conflict with the executive.

No matter what agenda the president seeks to impose by executive order, Congress should stop him. The body to which the Constitution delegates “all legislative powers herein granted” must assert its authority. In a constitutional republic, one man should not have kingly powers — and the Constitution doesn’t grant them to him.

Posted on November 1, 2023 Posted to Cato@Liberty

China’s Heroic Unofficial Historians

Authoritarian—and not just authoritarian—governments typically see national history as an important way to shore up support for the regime. China is probably the most prominent example of that right now, as Xi Jinping and the Chinese Communist Party reinforce their efforts to teach every Chinese citizen the glories of the party’s history and to conceal the truth about such crimes as the land‐reform campaigns of the early fifties, the Cultural Revolution, the Great Leap Forward, and the Tiananmen Square massacre. But a new book reveals the efforts of unofficial historians to make sure the truth is not lost.

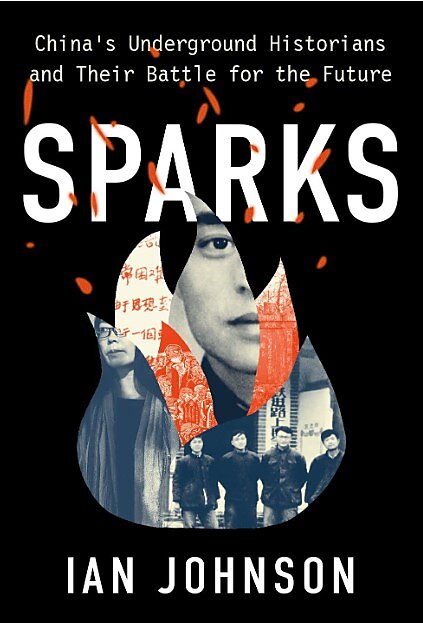

The book by Ian Johnson is Sparks: China’s Underground Historians and Their Battle for the Future. Ian Buruma has a long and informative review in the New Yorker:

Johnson’s underground historians are mostly concerned with unearthing and keeping alive forbidden memories of the past. Official Party history, imposed on China’s population, is also a matter of official forgetting. Many people born in China after 1989 have never heard of the Tiananmen massacre. Many of the young people who lived through the Cultural Revolution, in the nineteen‐sixties and early seventies, would have had limited knowledge of the Great Leap Forward, in the late fifties and early sixties, when Mao’s crackpot schemes for industrial and agricultural transformation caused tens of millions of deaths from starvation. And many of those who starved may not have been fully aware of the land‐reform campaigns of the early fifties, when vast numbers of people were murdered as class enemies, because they owned some land (as Mao’s father did, but that is a fact Party ideologues prefer to keep quiet).

The book’s title comes from a secretly mimeographed magazine, Spark, that began in 1960. It lasted only two issues, “and some of the contributors were executed as ‘counter‐revolutionaries’ after spending years in prison under horrifying conditions.” But it inspired “the writers, the scholars, the poets, and the filmmakers who found the courage to challenge Communist Party propaganda.”

Johnson describes efforts over many decades and also ongoing work today. Of course, “None of this work can be released in China.… But Johnson’s underground historians are mostly concerned with unearthing and keeping alive forbidden memories of the past. Official Party history, imposed on China’s population, is also a matter of official forgetting.”

It’s an inspiring story. And of course China is not the only country trying to craft an official history that may veer far from the truth. The Soviet Union pioneered official history and official forgetting before Mao came to power and before George Orwell wrote Nineteen Eighty‐Four. After the fall of the USSR the dissident and human rights activist Vladimir Bukovsky, who late in life was a Cato senior fellow, devoted much of his efforts, along with organizations as Memorial, to exposing the crimes of the Communist Party.

Of course, history is a concern of liberal and democratic countries as well. Shakespeare wrote plays that promoted the claims and the achievement of the Tudor dynasty, which was most pleasing to Queen Elizabeth I. The American Founders believed that the study of history is our best guide to the present and the future. The authors of the Federalist Papers wrote of history as “the oracle of truth” and “the least fallible guide of human opinions.” From their study of history they learned of the ancient rights of Englishmen, the importance of individual virtue in preserving freedom, and the dangers of power and thus the necessity of constraining and dividing it.

History helps us to understand the development of our civilization, including the ideas that shape it. Often the ideas that we now regard as universal principles arose in response to particular circumstances. Magna Carta and similar medieval charters reflect the struggle to constrain the power of kings. From such guarantees of specific liberties, eventually liberty developed. The rights guaranteed in the Bill of Rights reflected particular historical experiences: with religious wars, censorship, confiscation of property, the Star Chamber, and the constant tendency of government to seek more power.

People get much of their understanding of government and policy from history. The way we view the Constitution, slavery, Jim Crow, the industrial revolution, the robber barons, the New Deal, and other historical events shapes our view of the present. And in a liberal society we’re not always going to agree on the lessons or even the facts of history.

Scholars such as Frances Fitzgerald have written about past battles over how to tell the American story. And of course we’re having heated disputes today over how to understand and teach American history.

But for now I want to focus on the courageous efforts of Chinese citizens who have given so much to keep the truth alive. And I’ll also note that we at the Cato Institute have done our very little bit to introduce dissident ideas into China.

During the post‐Mao opening Cato held conferences on liberty, limited government, and free markets in China in 1988, 1997, 2000, and 2001. The 1988 conference, featuring Milton Friedman, numerous Chinese scholars, and a Friedman meeting with Premier Zhao Ziyang, was surely the first conference on market liberalism in Chinese history. Papers from the conference were published in both English and Chinese (English title Economic Reform in China), as were papers from the 1997 conference (China in the New Millennium). Several Cato books have been published in China: my Libertarianism: A Primer (later updated as The Libertarian Mind) in 2012, Johan Norberg’s books In Defense of Global Capitalism and Progress, Randal O’Toole’s Gridlock and The Best‐Laid Plans, and just last month the Cato Handbook for Policymakers.

Ian Johnson is telling an important story of heroic Chinese people who for more than 60 years have been making sure historical truth is not lost in a great country.

Posted on October 6, 2023 Posted to Cato@Liberty

In Defense of Globalization

We hear a lot of debates these days about globalization. What is globalization? Globalization is simply the process of the free movement of goods, capital, people, and ideas around the world and across borders.

leadGlobalization is a great boon to the world. It means more specialization and division of labor, which are vital components of economic progress. It makes rich countries richer and brings poor countries out of crushing poverty.

Market reforms within countries are important, but becoming part of the global division of labor has been crucial to the rise of middle classes in China, India, Mexico, Chile, and eastern Europe. The proportion of the world population in extreme poverty, i.e. who consume less than $1.90 a day, adjusted for local prices, declined from 36 percent in 1990 to 10 percent in 2015.

That’s the biggest story of the epoch, maybe the greatest achievement in human history. As Max Roser of Our World in Data points out, newspapers could have run the headline NUMBER OF PEOPLE IN EXTREME POVERTY FELL BY 137,000 SINCE YESTERDAY every day for 25 years.

But people don’t know this!

In a recent poll 66 percent of Americans thought world poverty had doubled. A free economy is not a zero‐sum game. Trade and specialization are win‐win. The pie grows for everyone.

And what’s the alternative? Self‐sufficiency? As Leonard Read and Milton Friedman pointed out, no single person on earth can make something as simple as a pencil. You’d need wood from Oregon, graphite from Sri Lanka, wax from Mexico, castor oil from the tropics, and rubber from Indonesia. Not to mention factories to combine those elements into a pencil.

Andy George, host of the Youtube show How to Make Everything, decided to make a chicken sandwich from scratch. It turned out to mean spending six months and $1,500 growing a garden, turning ocean water into salt, making cheese, and killing a chicken all so he could take a bite of a sandwich truly made from scratch.

From both President Trump and President Biden, we hear a lot about “Buy American.” That’s almost as senseless as making a chicken sandwich from scratch. The raw materials, the labor, and the technology necessary to produce the elements of modern life are spread across the globe. It would be vastly more expensive for any country – the United States, India, Nigeria – to refuse to trade with people in other countries to produce goods cheaply and efficiently.

And if it makes sense to “buy American,” why not “buy California”? “Buy Los Angeles”? “Keep our money here in Hollywood!”

As trade specialist Dan Ikenson observed in 2009, most of our modern products should be labeled “Made on Earth,” produced by “a truly global division of labor, [with] opportunities for specialization, collaboration, and exchange on scales once unimaginable.”

In the past generation globalization has brought more people into the world economy, and billions of people are rising out of poverty.

At the same time Enlightenment values of tolerance and human rights are spreading to more parts of the world, with particular emphasis on the rights of women, racial and religious minorities, and gay and lesbian people.

The Internet is giving people more information, more ways to connect, more commercial opportunities, and more choice. Despite what we may be led to think from the flood of information about the world, we are probably living in the most peaceful era in history.

But economic progress inevitably means change. And change can be painful. Think of the transition from 90 percent of American workers working on farms, to about 2 percent today. Now we’re in similar transitions from manufacturing to services and robots.

Some people get hurt in such transitions. They may lose their jobs, or their businesses, or see their own wages not increasing as fast as other people’s, or simply fear that such consequences may happen. And when people perceive a decline in their income or their relative social status, they often want help, and they want to blame someone. That can mean both a demand for government programs and the scapegoating of villains – whether it’s the bankers, the 1 percent, the Jews, the immigrants, the Mexicans, or whoever – just the opposite of the individualist liberalism that gave us the unprecedented progress we have experienced.

We’ve seen a rise of populist and illiberal forces in countries around the world, on both left and right – with threats to liberty, democracy, trade, growth, and even peace. All the bad new ideas – socialism, protectionism, industrial policy — are really bad old ideas. Libertarians and classical liberals have been fighting them off for more than 200 years, and we need to keep doing it.

Posted on September 22, 2023 Posted to Cato@Liberty

In 1932–33 Leading Intellectuals Used ‘Dictatorial’ as a Positive Recommendation

It’s hard not to despair at the state of public policy discussion these days. Every day’s newspaper contains another bad idea from politicians, pundits, and wonks from across the political spectrum, from rent control to corporate subsidies to trillion‐dollar handouts to costly regulations to red vs. blue cultural war games. It could keep an entire institute busy analyzing, criticizing, and warning about looming policy errors. As bad as the current climate is, though, I was reminded this week that we’ve lived through worse policy enthusiasms.

In his recent book Freedom’s Furies: How Isabel Paterson, Rose Wilder Lane, and Ayn Rand Found Liberty in an Age of Darkness, Timothy Sandefur describes the intellectual climate that those “founding mothers of libertarianism” faced in the Hoover‐Roosevelt Depression years:

Between 1917 and 1919, agencies such as the War Industries Board and [Herbert] Hoover’s U.S. Food Administration appeared to vindicate Progressive beliefs in government planning. A decade later, many—including Hoover himself—pointed to that precedent, arguing that the Depression was analogous to a world war and should be dealt with in the same way.

That was the basis for the idea that General Electric’s president Gerard Swope proposed in September 1931. He recommended that the federal government create a system of industrial cartels under which all companies of more than 50 employees would be assigned to a trade association vested with authority to dictate the types and amounts of goods and services businesses could provide, and how much they could charge. This would prevent “destructive” competition, by giving companies the power to prohibit their competitors from reducing prices or introducing new or improved products, which would “stabilize” the economy and ensure full employment. “Industry is not primarily for profit but rather for service,” Swope declared. “One cannot loudly call for more stability in business and get it on a purely voluntary basis.” Although hardly the only such proposal—it mimicked the corporatism already being implemented in Italy and Germany—the Swope Plan gained the most attention and would later form the blueprint for the National Industrial Recovery Act. But at the time, Hoover labeled it “fascism” and rejected it as “merely a remaking of Mussolini’s ‘corporate state.’”

Many similar schemes were offered by prominent intellectuals, including historian Charles Beard, who proposed “A Five‐Year Plan for America” on the Soviet model, and New Republic editor George Soule, whose 1932 book A Planned Society proposed political control over the entire economy. These writers, said one of Soule’s colleagues, “were impatient for the coming of the Revolution; they talked of it, dreamed of it.” And they were not alone. That same year, novelist Theodore Dreiser published Tragic America, which he had originally planned to call A New Deal for America. It advocated the overthrow of capitalism and the replacement of the Constitution with a government that would control industry in the style of the Soviet Union, where he thought communism was “functioning admirably.”…

Dreiser probably changed his title because A New Deal had already been taken by economist Stuart Chase, whose book of that name also appeared in 1932. Chase—who considered it “a pity” that “the road” to socialist revolution in America was “temporarily closed”—looked forward to the day when the government would seize all industry and “solv[e] at a single stroke unemployment and inadequate standards of living.” It would do this, he said, by compelling all individuals to “work for the community.” The government should forbid high interest rates, stock market speculation, the manufacturing of “useless” products, the creation of new clothing styles, businesses “rushing blindly to compete,” and other “ways of making money”—and it should do so “by firing squad if necessary.” The 44‐year‐old Chase was inspired by the “new religion” of “Red Revolution,” which he found “dramatic, idealistic, and, in the long run, constructive.” “Why,” he asked, “should the Russians have all the fun of remaking a world?”

A system of industrial cartels under which all companies of more than 50 employees would be assigned to a trade association vested with authority to dictate the types and amounts of goods and services businesses could provide, and how much they could charge. A Five‐Year Plan. Political control over the entire economy. Replacement of the Constitution with a government that would control industry in the style of the Soviet Union. Seize all industry. Compel all individuals to “work for the community.”

As bad as our policy dialogue is in 2023, we don’t hear mainstream commentators calling for five‐year plans and top‐down control of the entire economy. It seems that libertarian and free‐market ideas, along with our experience of overweening government in the United States and especially in other countries, have had some influence.

At the time, though, these ideas were not just wishful thinking by ivory tower academics. Consider some commentary from March 1933, when Franklin D. Roosevelt was inaugurated as president.

In his inaugural address Roosevelt declared, “We must move as a trained and loyal army willing to sacrifice for the good of a common discipline, because without such discipline no progress is made, no leadership becomes effective. We are, I know, ready and willing to submit our lives and property to such discipline.… I assume unhesitatingly the leadership of this great army of our people dedicated to a disciplined attack upon our common problems.” And if Congress didn’t promptly pass his agenda, “I shall ask the Congress for the one remaining instrument to meet the crisis—broad Executive power to wage a war against the emergency, as great as the power that would be given to me if we were in fact invaded by a foreign foe.…The people of the United States … have asked for discipline and direction under leadership.” And as Sandefur reports, plenty of people who ought to have seen themselves as guardians of constitutional liberty fell in line:

Fearful Americans cannot have been reassured by the February editorial in Barron’s that advocated “a mild species of dictatorship,” or by Walter Lippmann’s advice to the new president that same month—“You have no alternative but to assume dictatorial powers”—or by the New York Times reporter who proclaimed in May that Americans had given Roosevelt “the authority of a dictator” as “a free gift, a sort of unanimous power of attorney.… America today literally asks for orders.” Publisher William Randolph Hearst—who admired Mussolini and Hitler so much that he gave them columns in his newspapers—financed a propaganda film called Gabriel over the White House, which premiered days after the inauguration and depicted the new president being guided by heaven to declare martial law, unilaterally cure the Depression, execute criminals, and end all war. Even the Nazi Party celebrated Roosevelt’s commitment to all‐encompassing power with a story in its newspaper lauding what it called “Roosevelt’s Dictatorial Recovery Measures.”

In some ways the real counterattack on this collectivist, centralist mindset began a decade later with the publication in 1943 of Paterson’s The God of the Machine, Lane’s The Discovery of Freedom, Rand’s The Fountainhead, and in 1944 of F. A. Hayek’s The Road to Serfdom. But as our current challenges illustrate, this intellectual battle is far from over.

Posted on September 21, 2023 Posted to Cato@Liberty

David Boaz gives the presentation, “Embracing The Enlightenment: Classical Liberal Response to a Growing Illiberalism,” hosted by Freedom Fest Memphis

Posted on September 21, 2023 Posted to Cato@Liberty

Time for Pandemic Emergency Spending to End

New exercises of federal spending power are often justified on the basis of some emergency. Both the Hoover and Roosevelt administrations cited high unemployment and poverty in the Depression as justification for new transfer payments, such as farm subsidies and AFDC (“welfare”). When the emergency ended, the programs continued.

As economists would predict, any government payment program will create its own constituency. Program recipients will not willingly give up their source of income just because the emergency has ended. We’re now dealing with the latest example, the possible sunsetting of pandemic relief payments.

In March 2020, as government started to respond to the spread of the novel coronavirus, multi‐trillion‐dollar relief programs were quickly passed into law. Now some of those programs — and their recipients — are facing statutory deadlines. Which makes sense because the programs were justified on the grounds of keeping firms in business and employees supported. But the COVID-19 emergency has now ended, the economy is strong, and unemployment is low.

As usual, journalists are rushing to cover the plight of people who may lose their emergency benefits. A Washington Post article is headlined, “The incredible American retreat on government aid.” Note first that there is no retreat from the level of government transfer payments that existed in 2019. The concern is simply with new emergency programs dating from 2020 or later. The Post uses urgent language to bemoan

the expiration of a wave of federal programs passed in response to the pandemic to make life easier for millions of Americans.

- Millions — possibly tens of millions — are losing Medicaid coverage, the result of the end of a covid‐era program that gave federal aid to states that kept people continuously enrolled rather than carry out regular purges of the rolls.

- Billions in covid‐era federal funding to keep child‐care centers open expire at the end of September, leaving states to scramble in the face of estimates 70,000 facilities could close and 3.2 million children (mostly five years old or younger) could lose their care.

- That would have enormous ripple effects across the economy, forcing some proportion of parents out of their jobs to care for their children.

The article goes on to mourn the expirations of such other emergency programs as expansion of the Women, Infants, and Children food aid, student loan repayment suspensions, eviction moratoriums, and enhanced unemployment benefits.

Now it’s easy to find individuals who have benefited financially from these programs. But emergency payments, like any other government spending, have detrimental effects as well, and those are not considered in the Post article.

Federal spending skyrocketed in 2020 and beyond, and money diverted to federal purposes is money that is not available to private businesses and individuals, money that doesn’t contribute to job creation and economic growth. It did, however, contribute to the highest levels of inflation since the 1970s.

At Cato, we knew the risk that emergency programs would become permanent. As Ronald Reagan said in his famous 1964 speech, “No government ever voluntarily reduces itself in size. So, governments’ programs, once launched, never disappear. Actually, a government bureau is the nearest thing to eternal life we’ll ever see on this earth.”

In March 2020 Cato president Peter Goettler wrote in a letter to lawmakers, “Extraordinary measures must end with the passing of the crisis, and sunset clauses included in all emergency legislation.”

And staff writer Andy Craig wrote, “And perhaps most importantly: emergency rules and powers should extend only for the duration of the emergency, and be repealed at the earliest feasible opportunity. We should be wary of the ratchet effect, where governments tend to retain powers and keep open programs long after their original justification has disappeared.”

But it’s very difficult to get policymakers to make a binding commitment that temporary emergency programs will genuinely end when circumstances change.

That’s why the federal subsidy to wool and mohair producers, created in 1954 to increase domestic production of military uniforms, is still in effect decades after the Pentagon’s interest in the program ended. The difference is, that program is a budgetary rounding error compared to the trillion‐dollar pandemic programs.

In the next perceived crisis, Congress will again move to demonstrate its concern by voting for massive spending programs. I hope that our current experience will remind future legislators to be far more cautious about creating “temporary,” “emergency” spending commitments.

Posted on September 11, 2023 Posted to Cato@Liberty

Now More than Ever, Americans Should Defend Liberalism

Liberalism, the most successful political and economic system in history, is under sustained assault on all sides.

leadAs historically understood, liberalism is a political philosophy based on a commitment to individual liberty, constitutional government, the rule of law, toleration, civil liberties, private property, and a market economy. Any movement that is not a cult has its disagreements, and some people who call themselves liberals may emphasize some items on that list over others. But liberalism is defined by general acceptance of those principles.

Those principles are so fundamental to the United States and most of the Western world that we may not think of them as a particular political philosophy. But, in fact, liberalism represented a break from the pre‐liberal world. Liberal thinking and movements challenged the world of absolute monarchs and privileged aristocrats, established religions, persecution, colonialism, empire, mercantilism, and war. In the name of liberty and dignity, liberalism supported “careers open to talent,” the rule of law, free exchange, and peace.

Liberalism changed the world. We’re all so much richer than our grandparents, even if we had rich grandparents. The economic historian Deirdre McCloskey describes the process as “technological and institutional betterment at a frenetic pace, tested by unforced exchange among the parties involved.” Otherwise known as “market‐tested betterment,” it set in motion something previously unknown: sustained and compounding economic growth. We live longer, better, healthier and more comfortable lives than our ancestors.

McCloskey estimates people in the West are at least 30 times richer than their ancestors in 1800—or, considering quality improvements, as much as 100 times richer. Standards of living rose faster in countries that adopted liberal policies than in those that didn’t. But everywhere — in China, India, Africa, Europe and the Americas — globalization and freer markets are raising real incomes and making poor people better off.

Thanks to markets and globalization, the share of the world’s population living in extreme poverty fell from 36 percent in 1990 to 12 percent in 2015 — less than 1 percent in China. Child mortality plummeted; education, literacy, and vaccination soared. As Max Roser of Our World in Datapoints out, newspapers could have run the headline NUMBER OF PEOPLE IN EXTREME POVERTY FELL BY 137,000 SINCE YESTERDAY every day for 25 years.

By 2016, Northern Chinese families that were literally living in caves in the 1990s had brick homes with electricity, clean water and children in school. “When countries see sustained economic growth, you also see declining absolute poverty,” said Charles Kenny of the Center for Global Development. “It’s as close to a universal law as we have.”

And perhaps more importantly, liberalism has liberated billions of people from lives of enforced obedience via slavery and serfdom, from the humiliation of caste, segregation, and apartheid, and generally from having to live as others tell you to live. The promises of the Declaration of Independence—life, liberty, and the pursuit of happiness—are being extended, in the U.S. and elsewhere, to people to whom they had long been denied.

And yet in the face of this overwhelming, though still imperfect, progress, liberalism is under sustained attack from many sides. Ruthless dictators, such as Xi Jinping, Vladimir Putin, Mohammed bin Salman, and the Supreme Leader of Iran forcibly crush dissident voices. They’re also waging well‐funded information warfare on liberal societies. And some wobbly democracies have seen strongmen consolidate power. Recep Tayyip Erdoğan in Turkey, Hugo Chavez and his follower Nicolas Maduro in Venezuela, Narendra Modi in India, and Viktor Orban in Hungary are very actively developing new models of political dominance and eternal reelection.

While elements of the American left have always had a soft spot for every new socialist country—the Soviet Union, Mao Zedong’s China, Fidel Castro’s Cuba, Venezuela, Nicaragua, and even Zimbabwe—we now see American conservatives looking abroad for their versions of paradise, with many flocking to Hungary to admire and learn from Orban’s “illiberal democracy.”

In our own country we see self‐described conservatives in the Trump era embracing new policies of lavish spending, government control of trade and investment through protectionism, and “industrial policy,” which will subsidize favored companies. We have further seen a toxic culture war against transgender people and LGBTQ representation.

Conservatives have jettisoned Reagan‐era talk about freedom. Now they’re focused on power: how to get it and how to wield it to help their friends and to hurt their enemies. Meanwhile, on the left of the Democratic Party, we find growing attempts to censor dissident thoughts — or any discussion — on subjects from COVID-19 to navigating complex gender issues in sports. And there’s increasing talk about socialism.

Despite all the slings and arrows, the momentum of liberal reforms is still generating positive results, especially in the nation founded on the aspiration to protect the rights to life, liberty, and the pursuit of happiness. As The Economist noted in April, “Income per person in America was 24% higher than in western Europe in 1990 in [purchasing power parity] terms; today it is about 30% higher. It was 17% higher than in Japan in 1990; today it is 54% higher.”

Yet the new critics on right and left want us to be more like one or another European state, whether France or Hungary.

The U.S. is outpacing other economies, but we could certainly do better, starting with respecting the principles of supply and demand. Soaring housing prices are caused by restraints on supply and unemployment and labor shortages are caused by restrictions on wages and immigration. Restricting imports at the same time restricts exports (known as the Lerner Symmetry theorem), which means restricting wage growth.

Under both Republican and Democratic control of government, we need to constrain exploding government spending, address the growing national debt, and tackle the even bigger “unfunded liabilities” of Social Security and Medicare. We need to stop punishing work and creation through our complicated and punitive tax system. But economic reality doesn’t generally appeal to either left or right these days.

The lesson of the last three centuries is that liberalism works — it gives more people freedom and autonomy and opportunity, it dramatically increases standards of living, and it reduces both domestic and international conflicts.

And yet there are people who want to make the U.S. more like what Hungarian strongman Viktor Orbán calls his “illiberal democracy,” in which government controls society in the name of national greatness. In such an environment, liberals of all sorts — including Reaganite conservatives, free‐speech liberals, people who are fiscally conservative and socially liberal, and libertarians — need to see each other as allies in a broad liberal center and push back against organized attacks from those who would tear up and discard the principles of the Declaration of Independence.

Posted on July 20, 2023 Posted to Cato@Liberty

Another Athlete Chooses a Low‐Tax State

I’ve written before about whether athletes take state taxes into account when they weigh competing offers. Here’s another example: Grant Williams left the Boston Celtics for the Dallas Mavericks, at least partly because of Massachusetts’ Millionaire’s Tax:

Testing the market worked out for Williams, who will now make more money while living in Texas, which does not have state income tax. Williams reportedly turned down a four‐year, $48 million over offer from the Celtics last season.

Williams mentioned Massachusetts’ Millionaire’s Tax as one of the factors he was mindful of when considering the Celtics’ offers. The Millionaire’s Tax is a four percent tax on top of Massachusetts’ five percent income tax, which raises the tax rate to nine percent for millionaires.

“I was thankful just because I feel like the way my agent and everybody talked about it was that this was our floor,” Williams said. “In Boston, it’s really like $48 million with the millionaire’s tax, so $54 million in Dallas is really like $58 million in Boston and $63 million in L.A.”

Here’s what I wrote in 2019 when Bryce Harper chose Philadelphia over San Francisco:

Has California lost another centi‐millionaire because of its high tax rates? Washington Nationals superstar Bryce Harper just signed a 13‐year, $330 million contract with the Philadelphia Phillies, the largest contract in the history of major North American sports. (Though not the largest when adjusted for inflation.) Some reports say that the San Francisco Giants came very close in the competition but lost out because of California’s taxes. Alex Pavlovic of NBC tweeted:

“I’m told Giants made a 12‐year, $310 million offer to Bryce Harper. They were willing to go higher but would have had to go well over $330 million to get it done because of California taxes.”

If taxes did keep Harper on the East Coast, he wouldn’t be the first sports star to make such a decision. Trevor Ariza, a member of the Los Angeles Lakers’ 2009 NBA championship team and by 2014 “a key part of the Wizards’ playoff run,” decided to leave Washington and join the Houston Rockets. Why?

“Washington was disappointed but hardly shaken when Ariza chose to accept the same four‐year, $32 million contract offer in Houston, where the 29‐year‐old could pocket more money because the state doesn’t tax income.”

As I wrote then, yes, a $32 million salary – or indeed a $32,000 salary – goes further in Texas than in the District of Columbia. What economists call the “tax wedge” is the gap between what an employer pays for an employee’s services and what the employee receives after taxes. It causes some jobs to disappear entirely, as employees and employers may not be able to agree on a wage once taxes are taken out of the paycheck. It causes some employees to flee to lower‐tax countries, states, or cities. The Beatles, the Rolling Stones, Bono, and Gerard Depardieu are some of the better‐known “tax exiles.”

It isn’t just entertainers and athletes, of course. A 2018 study found that 138 millionaires left California after a 2012 tax increase. Millionaires have also been seen leaving Connecticut, New York, and New Jersey. Last fall Chris Edwards wrote about the impact of taxes on interstate moves.

As taxes rise in many states, no‐income‐tax states like Texas, Florida, Washington, Tennessee, and Nevada may become increasingly attractive to athletes, entertainers, and other high‐income producers.

Posted on July 10, 2023 Posted to Cato@Liberty

What Libertarianism Is and Isn’t

Here we go again. Another “obituary” for libertarianism. While Salon Magazine declares that we all live in a “libertarian dystopia,” and a new brand of big‐government conservatives promise to free the Republican party and American government from their libertarian captivity, Barton Swaim declares in the Wall Street Journal that a new book “works as an obituary” for libertarianism. That’s not a characterization that I think the authors—Matt Zwolinski and John Tomasi—would accept of their book, The Individualists: Radicals, Reactionaries, and the Struggle for the Soul of Libertarianism.

Swaim notes that the book surveys many different kinds of self‐styled libertarians over the past two centuries, and that the authors lay out six “markers” that libertarians share: property rights, individualism, free markets, skepticism of authority, negative liberties, and a belief that people are best left to order themselves spontaneously. Not a bad list, significantly overlapping with the list of seven key libertarian ideas that I laid out in the first chapter of my own book, The Libertarian Mind.

He goes on to argue, following the authors, “In the 21st century, the movement in the U.S. has consisted in an assortment of competing, often disputatious intellectual cadres: anarchists, anarcho‐capitalists, paleo‐libertarians (right‐wing), ‘liberaltarians’ (left‐wing) and many others.” Somehow he leaves out actual libertarians, such as those who populate the Cato Institute, Reason magazine, the Objectivist world, and much of the Libertarian Party. Indeed, a few lines later he cites the “diversity” of “the priestess of capitalism Ayn Rand, the politician Rand Paul and the billionaire philanthropist Charles Koch”—none of whom would fall into any of the esoteric categories that he suggests make up modern libertarianism and in fact belong to actual libertarianism or its penumbras.

The whole review is ahistorical. Swaim never mentions classical liberalism, the revolutionary movement that challenged monarchs, autocrats, mercantilism, caste society, and established churches beginning in the 18th century. Liberalism soon swept the United States and Western Europe and ushered in what economic historian Deirdre McCloskey calls the “Great Enrichment,” the unprecedented rise in living standards that has made us moderns some 3,000 percent richer than our ancestors of 1800. The ideas of the classical liberals, including John Locke, Adam Smith, and the American Founders, are those that animate modern libertarianism: equal rights, constitutional government, free markets, tolerance, the rule of law. Zwolinski and Tomasi say that “what sets libertarians apart is the absolutism and systematicity” with which we advocate those ideas. Well, yes, after 200 years of historical observation and philosophical and economic debate, many of us do believe that a firmer adherence to liberal/libertarian ideas would serve society well. We observe that the closer a society comes to consistent tolerance, free markets, and the rule of law, the more it will achieve widespread peace, prosperity, and freedom.

Swaim insists that libertarians do not engage “with ultimate questions—questions about the good life, morality, religious meaning, human purpose and so on.” He’s wrong about that. Adam Smith wrote The Theory of Moral Sentiments. F. A. Hayek stressed the importance of morals and tradition. Ayn Rand set out a fairly strict code of personal ethics. Thomas Szasz’s work challenged the reductionists and behaviorists with a commitment to the old ideas of good and bad, right and wrong, and responsibility for one’s choices. Charles Murray emphasizes the value and indeed the necessity of community and responsibility. Libertarian philosophers of virtue ethics find the case for limited government to be based on the search for the good life. Swaim would be on more solid ground to say that libertarianism does not presume to tell individuals what to believe and how to live. Separation of church and state and all that. As I wrote in a letter to the Journal (not yet published), Swaim refers to the “studiously amoral philosophy of libertarianism.” A popular summary of libertarianism, “don’t hit other people, don’t take their stuff, and keep your promises,” is just the basic morality that allows human beings to live together in peace.

As for his claim that libertarianism is dead, that this book is an obituary, I refer Swaim again to all the people who complain that we’re living in some sort of libertarian world. Libertarians often feel depressed; they believe the world is on “the road to serfdom.” But in fact the world is far freer in this century than ever before in history. Free markets and free trade, an end to slavery and caste societies, representative government, and the rule of law now govern the Western world and much of the rest. Most of the Cato Institute’s website comprises complaints about the malfeasance of the U.S. government. But in the bigger picture, libertarians have had much success. In the roughly 50 years since I started thinking about politics, one could point to such successes as:

- the end of conscription in the United States

- social, economic, and political equality for women

- dramatically lower marginal tax rates

- freer trade

- deregulation of major industries such as airlines, trucking, communication, and finance

- the almost total demise of communism

- and the consequent discrediting of socialism and central planning

- the reorientation of antitrust policy to a consumer welfare standard

- expanded First Amendment protections

- expanded Second Amendment protections

- the progress of gay rights and gay marriage

- growing opportunities for school choice

- a slow erosion of the war on drugs

I could go on. None of these are total victories. No ideology achieves all of its sweeping vision, at least not without a military conquest of the government and the ability to rule by decree—and those experiments are nothing to emulate. In various parts of the world bad ideas are back—socialism, protectionism, ethnic nationalism, anti‐Semitism, even industrial policy. The libertarian challenge is to join with other liberals—Reaganite conservatives, free‐speech liberals, people who are “fiscally conservative and socially liberal”—to push back against these bad resurgent ideas. But this record of accomplishment is no obituary.

Posted on June 30, 2023 Posted to Cato@Liberty